In the past couple of years, Uniswap DAO has deployed univ3 on many L2s. Liquidity Providers should have more data about which L2s have been the most profitable for specific token pairs. This is our attempt to demystify some of it.

Chains tracked: Ethereum, Arbitrum, Optimism, Polygon, Base, Celo

BNB and Avalanche were not included in this research due to their being their own L1 chains.

In this research, we first took the top pools from each chain and made the common top pools part of our research. Except for Base and Celo, the top pools on all the other chains were similar.

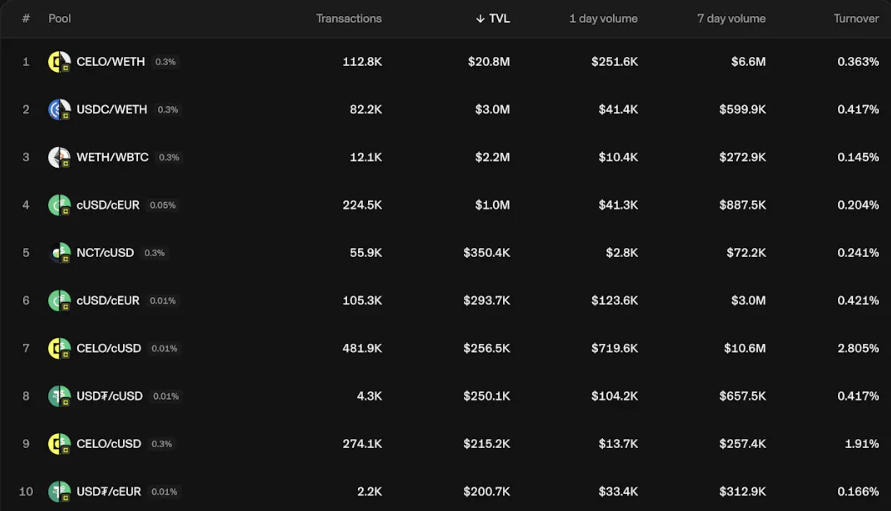

On Base, blue chip tokens struggled to make it to the top 10. Here is a snapshot of the top pools by 7D volume on Base:

Celo has a lot of local pools in the top 10 which were again not made part of this research.

In the case of Arbitrum, Optimism, and Polygon, liquidity and volume were fragmented between USDC and USDC.e (bridged from Ethereum), and both versions of the stablecoin are part of this research to help LPs make a better decision.

How Was This Research Conducted?

~$100 worth of liquidity was provided in each pool on 25 February 2024 until 25 March 2024. Please note that this research does not consider impermanent loss or LVR. The only focus is on fee generation.

Pools And Their Ranges

ETH-Stable Pairs

Lower Tick: 2993.974 USD per ETH

Upper Tick: 4410.486 USD per ETH

ETH-WBTC Pairs

Lower Tick: 0.0499 WBTC per ETH

Upper Tick: 0.0588 WBTC per ETH

ETH-wstETH Pairs

Lower Tick: 0.845 wstETH per ETH

Upper Tick: 0.882 wstETH per ETH

WBTC-Stable Pairs

Lower Tick: 57907.855 USD per WBTC

Upper Tick: 84184.290 USD per WBTC

USDC-USDT Pairs

Lower Tick: 0.990 USDT per USDC

Upper Tick: 1.015 USDT per USDC

You can find all related pool data here:

https://docs.google.com/spreadsheets/d/15e4W9N0bm6zYJ-eY-nogSiADnxqfYvtOrUbkRYgakcI/edit?usp=sharing

ETH-USDC

ETH-USDC

Polygon’s ETH-USDC 0.3% pool produced the highest fee return at $18.9 followed by Polygon’s ETH-USDC 0.05% pool. Base’s pools performed the worst. Ethereum, Arbitrum, and Optmism were on par with each other.

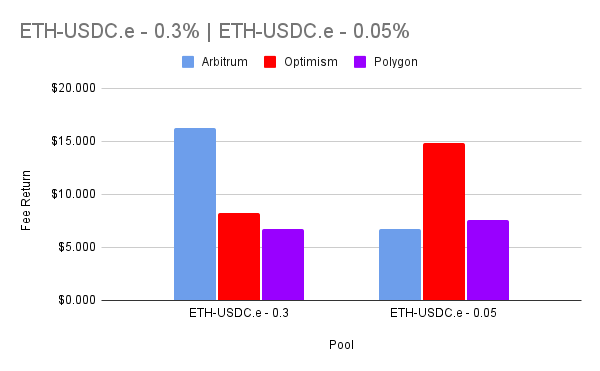

ETH-USDC.e

Arbitrum’s 0.3% pool performed the best with $16.2 in fee generation with Optimism’s 0.05% pool at almost $15 being close second.

ETH-USDbC / ETH-USDCET

ETH-USDbC pool on Base generated $3.57 and $4.3 respectively.

Celo’s ETH-USDCET generated $8.9.

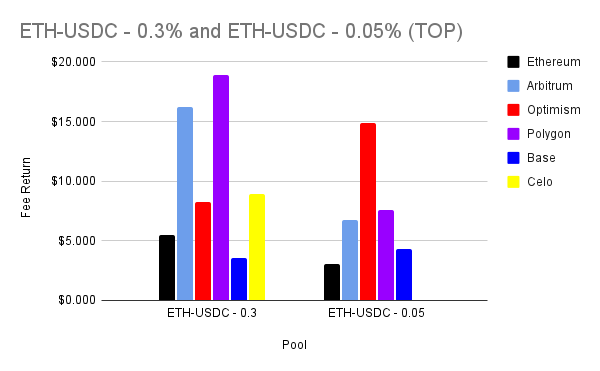

ETH-USDC (Top Pools)

The chart above combines and compares all the top-performing ETH-USDC pools on all six chains. This chart does not distinguish between the different versions of USDC. For more detailed information on the different versions of USDC, see the charts above.

Here Polygon’s 0.3%, Arbitrum’s 0.3% pool, and Optimism’s 0.05% pool are the top 3 performing pools. Ethereum’s fee generation is lacking far behind them.

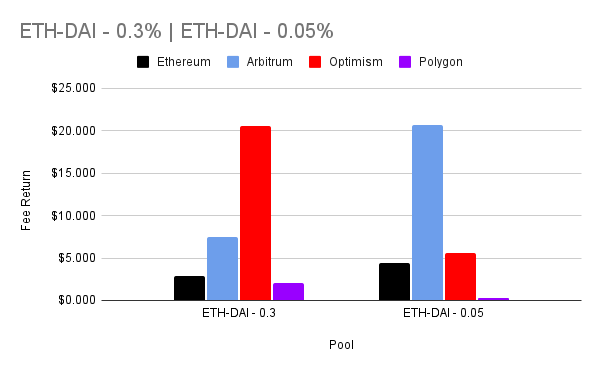

ETH-DAI

Ethereum’s and Polygon’s ETH-DAI pools are lagging far behind Arbitrum’s ETH-DAI 0.3% pool with $20.7 generated and Optimism’s ETH-DAI pool with $20.5 generated.

ETH-USDT

Arbitrum’s ETH-USDT 0.05% pool takes the cake with the highest fees generated at $9 followed by Polygon’s ETH-USDT 0.3% pool at $6.7

ETH-WBTC

Arbitrum wins here hands-down in ETH-WBTC 0.3% and ETH-WBTC 0.05% with fee generation of $10.3 and $6.87 respectively.

ETH-wstETH

This is the first and only LST pair in our research. We thought this pair was a good proxy for the overall trading volume in the LST space.

Ethereum’s volume here is not a surprise given that most LST assets are still on Ethereum. What’s surprising is that Base has generated the most fees in the given time frame with the 0.05% pool generating $1.32, perhaps this is an outlier and Base won’t be able to keep up with Ethereum in this pair in the next few months.

WBTC-USDC

WBTC-USDC

Optimism’s both pools generated more fees than Ethereum with 0.3% at $10.2 and 0.05% at $11.6.

WBTC-USDC.e

Optimism again takes the win here with the 0.3% pool generating $23.3.

WBTC-USDC (Top Pools)

The chart above combines and compares all the top-performing WBTC-USDC pools. This chart does not distinguish between the different versions of USDC. For more detailed information on the different versions of USDC, see the charts above.

Here Optimism’s 0.3% pool, Optimism’s 0.05% pool, and Ethereum’s 0.3% are the top performing in terms of fee generation.

USDC-USDT

USDC-USDT

This is the first time that Ethereum has generated more fees on any token pairs. Perhaps the bulk of the stablecoin trading is still happening on Ethereum.

Ethereum’s 0.05% pool generated $0.15 and the 0.01% pool generated $0.06.

USDC.e-USDT

Polygon’s 0.05% is the top-performing pool here.

USDC-USDT (Top Pools)

The chart above combines and compares all the top-performing USDC-USDT pools. This chart does not distinguish between the different versions of USDC. For more detailed information on the different versions of USDC, see the charts above.

Ethereum is the clear winner in both fee tiers with the 0.05% pool at $0.15 and the 0.01% pool at $0.06.

Summary

In our research with the limited pools, L2s fee generation has outperformed Ethereum L1. Although TVL and overall volume are still higher on Ethereum, but LPing is more profitable on L2s. LPs should consider the past data before deciding which chain to deploy the liquidity on. Polygon led the ETH-USDC pools, Arbitrum led the ETH-DAI, ETH-USDT, and ETH-WBTC pools, Ethereum ETH-wstETH and USDC-USDT pools and Optimism led the fees generation on WBTC-USDC pools.

Also read: Optimism Bedrock: An Early Guide