Bill Gates Says His Divorce From Melinda Is His Greatest Regret

Bill Gates recently got candid about his divorce from his wife, Melinda Gates, calling it the mistake he regrets the most.

The pair, who had been married for over 27 years, went their separate ways in 2021 in a billion-dollar divorce.

Since their separation, Bill Gates and Melinda Gates have remained amicable and have moved on with new partners.

Article continues below advertisement

Bill Gates Calls Divorce From Melinda His Greatest Regret

In an interview with The Sunday Times, Bill reflected on his 27-year marriage to Melinda Gates and their divorce, calling it “the mistake I regret the most in my life.”

While the 69-year-old Microsoft co-founder acknowledged he has faced other setbacks, he emphasized that none compare to the pain of the split.

“There are other mistakes, but this one stands above all,” he said, describing the divorce as a “miserable” experience for both him and Melinda, lasting at “least two years.”

Despite the challenges, the former couple has managed to maintain a cordial relationship. Both have since moved on and are dating other people.

Article continues below advertisement

“Melinda and I still see each other — we have three kids and two grandchildren, so there are family events,” Bill noted, referencing family events with their three children and two grandchildren. “The kids are doing well. They have good values.”

Reflecting on their marriage, Bill credited it with keeping him “grounded” during the creation and growth of his trillion-dollar company.

Article continues below advertisement

Melinda Gates Called The Split The ‘Lowest Moment’ In Her Life

Bill and Melinda tied the knot in 1994 and share three children: Jennifer, 28, Rory, 25, and Phoebe, 22. The couple announced their divorce in May 2021 but had been living separately for a year before going public with the news.

In a 2022 interview with USA Today, Melinda, now 60, revealed that it was a “sad day” for her when she realized she was done with her marriage to the billionaire.

While she described the decision to separate as the “healthier choice” for both of them, Melinda also called it the “lowest moment” in her life.

“That wasn’t something I ever thought would happen to me,” she said. “It certainly wasn’t what I thought on the day I got married, but I realized for myself, I needed to make a healthier choice, and that was just a very, very sad day.”

Article continues below advertisement

Bill Gates Admitted To Making Mistakes In Their Marriage

Bill, for his part, has taken accountability for his role in his split from Melinda after 27 years of marriage.

In a 2022 interview with Savannah Guthrie, he admitted to “causing pain” after his then-wife confronted him about reports of an affair with a Microsoft employee.

“I certainly made mistakes, and I take responsibility,” he said at the time.

Gates added, “I don’t think delving into the particulars at this point is constructive, but yes, I caused pain, and I feel terrible about that.”

Article continues below advertisement

Melinda Gates Criticized Bill’s Ties To Jeffrey Epstein

In a 2022 interview with Gayle King, Melinda also pointed to Bill’s association with convicted pedophile Jeffrey Epstein as a contributing factor to the breakdown of their marriage.

According to Page Six, she said: “I did not like that he had meetings with Jeffrey Epstein. no. I made that clear to him.” Melinda added, “He was abhorrent. He was evil personified.”

Bill has since described his professional ties with Epstein, who died by suicide in jail in August 2019 while awaiting trial on sex trafficking charges, as a “mistake.”

Following their split, Bill and Melinda have moved on in their personal lives. In October 2024, Melinda went public with her relationship with entrepreneur Philip Vaughn.

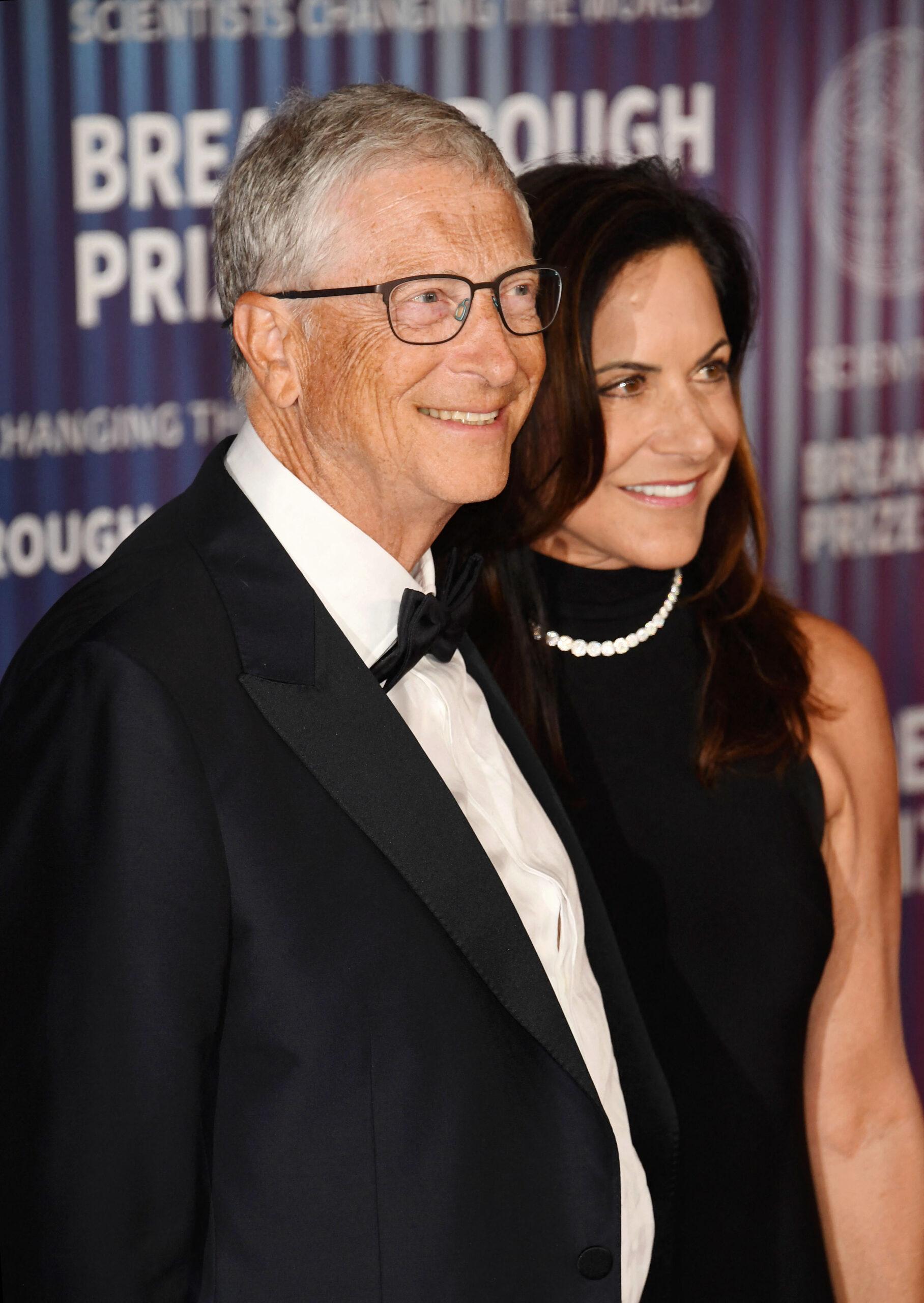

The two were spotted holding hands while heading to dinner at Le Bernardin in New York City. Bill, meanwhile, has been in a relationship with Paula Hurd, the widow of Oracle CEO Mark Hurd, since 2023.

Article continues below advertisement

Bill Gates Praises ‘Intriguing’ Dinner With Donald Trump

Bill recently shared details about a rare private dinner with President Donald Trump, describing the nearly three-hour meeting as “intriguing” and leaving him “impressed.”

Despite having supported Trump’s opponent, former Vice President Kamala Harris, in the 2024 election, Gates appeared optimistic after their conversation.

“I had a chance, about two weeks ago, to go have a long and actually quite intriguing dinner with him,” Bill told The Wall Street Journal.

During the wide-ranging discussion, he said they focused heavily on public health, an area central to his philanthropic efforts.

“I felt like he was energized and looking forward to helping to drive innovation,” Bill noted. “I was frankly impressed with how well he showed a lot of interest in the issues I brought up.”

These cushy and firm pillows are ideal for those that sleep on their side, but want maximum support when turned on their side. Not only does it help you to fall asleep faster, but it provides better neck and spine alignment for a more comfortable rest. The option to add a cooling pillow cover will keep you feeling fresh without overheating all night. There are also versions for children or for those that need to support their knees for better lower back support. Frequent travelers will appreciate the travel-sized versions that promote better rest when away from home.

These cushy and firm pillows are ideal for those that sleep on their side, but want maximum support when turned on their side. Not only does it help you to fall asleep faster, but it provides better neck and spine alignment for a more comfortable rest. The option to add a cooling pillow cover will keep you feeling fresh without overheating all night. There are also versions for children or for those that need to support their knees for better lower back support. Frequent travelers will appreciate the travel-sized versions that promote better rest when away from home. Eating when traveling means a lot of recipes that may be unfamiliar. It also means eating additives and preservatives you are not used to consuming. This can severely affect your health. That’s why the Kaloirk Vivid Touch Air Fryer is the perfect gift for frequent travelers to enjoy when they return home. For just over $100, its stainless steel design, colorful panel in numerous languages and cooking options truly impress. You enjoy your favorite fried foods without using oil, slicing your calories in more than half. It also does most of the cooking for you by adjusting the temperature based on the food type or cut. And when it’s time to shake, you’ll get a reminder for that, too.

Eating when traveling means a lot of recipes that may be unfamiliar. It also means eating additives and preservatives you are not used to consuming. This can severely affect your health. That’s why the Kaloirk Vivid Touch Air Fryer is the perfect gift for frequent travelers to enjoy when they return home. For just over $100, its stainless steel design, colorful panel in numerous languages and cooking options truly impress. You enjoy your favorite fried foods without using oil, slicing your calories in more than half. It also does most of the cooking for you by adjusting the temperature based on the food type or cut. And when it’s time to shake, you’ll get a reminder for that, too. Owned by a Korean woman’s small business, Regelica leans on the already bustling Korean beauty industry. The Mandelic + Edelweiss Renewal Serum helps to exfoliate the skin with natural ingredients and antioxidants. By using mandelic acid, it can also target pigmentation and wrinkles. The Vitamin C focuses on boosting elasticity and brightness, and this serum can be used twice a day making it a great gift for frequent flyers.

Owned by a Korean woman’s small business, Regelica leans on the already bustling Korean beauty industry. The Mandelic + Edelweiss Renewal Serum helps to exfoliate the skin with natural ingredients and antioxidants. By using mandelic acid, it can also target pigmentation and wrinkles. The Vitamin C focuses on boosting elasticity and brightness, and this serum can be used twice a day making it a great gift for frequent flyers. The bright red of this infrared tower is more than a symbol of romance, but also of health. The healing power of this light can boost your mood, reduce inflammation and wrinkles, improve sleep, target blemishes on the skin and reduce muscle pain. It is best for face, neck and upper body, but works all over the body to heal you from the outside in. While not convenient for travel, it is just the thing you need when you return home from a trip to energize and refresh by boosting energy into the cells’ mitochondria. It’s an anti-aging process that uses “photobiomodulation.” Other products include an LED mask that specifically targets the skin on your face. The tower fits easily on a desk, table, floor or tucked into a shelf in the corner of your room.

The bright red of this infrared tower is more than a symbol of romance, but also of health. The healing power of this light can boost your mood, reduce inflammation and wrinkles, improve sleep, target blemishes on the skin and reduce muscle pain. It is best for face, neck and upper body, but works all over the body to heal you from the outside in. While not convenient for travel, it is just the thing you need when you return home from a trip to energize and refresh by boosting energy into the cells’ mitochondria. It’s an anti-aging process that uses “photobiomodulation.” Other products include an LED mask that specifically targets the skin on your face. The tower fits easily on a desk, table, floor or tucked into a shelf in the corner of your room. This new motion belt has a different design, webbing and buckle than previous models and works well in both casual or business settings. It’s a one-size belt that fits your waist thanks to its stretching fabric. There are different patterns and designs that make it especially fun to have these lightweight belts in your carry-on travel bag. The material is sustainably sourced, and it comes with a lifetime guarantee (an extra bonus at this fair price point). The Motion Belt goes live Feb. 11.

This new motion belt has a different design, webbing and buckle than previous models and works well in both casual or business settings. It’s a one-size belt that fits your waist thanks to its stretching fabric. There are different patterns and designs that make it especially fun to have these lightweight belts in your carry-on travel bag. The material is sustainably sourced, and it comes with a lifetime guarantee (an extra bonus at this fair price point). The Motion Belt goes live Feb. 11.

![Married At First Sight: Allen Feels the Agony of Defeat – Recap [S18E11]](https://i2.wp.com/eadn-wc01-4272485.nxedge.io/wp-content/uploads/2025/01/married-at-first-sight-allen-slovick-9012.jpg?w=100&resize=100,75&ssl=1)