Victoria d’Este

Published: December 20, 2024 at 9:09 am Updated: December 20, 2024 at 9:09 am

Edited and fact-checked:

December 20, 2024 at 9:09 am

In Brief

Crypto market decline led to over $1 billion in leveraged positions liquidation, revealing unprepared traders.

A steep decline in the crypto market occurred, and within a day, leveraged positions worth over $1 billion were liquidated. After a month of robust bullish momentum, this event demonstrated how unprepared traders were for unforeseen market disruptions.

Notwithstanding the setback, some analysts speculate that this might not be the beginning of a long-term slide but rather a temporary correction.

Effects of Liquidation and Market Responses

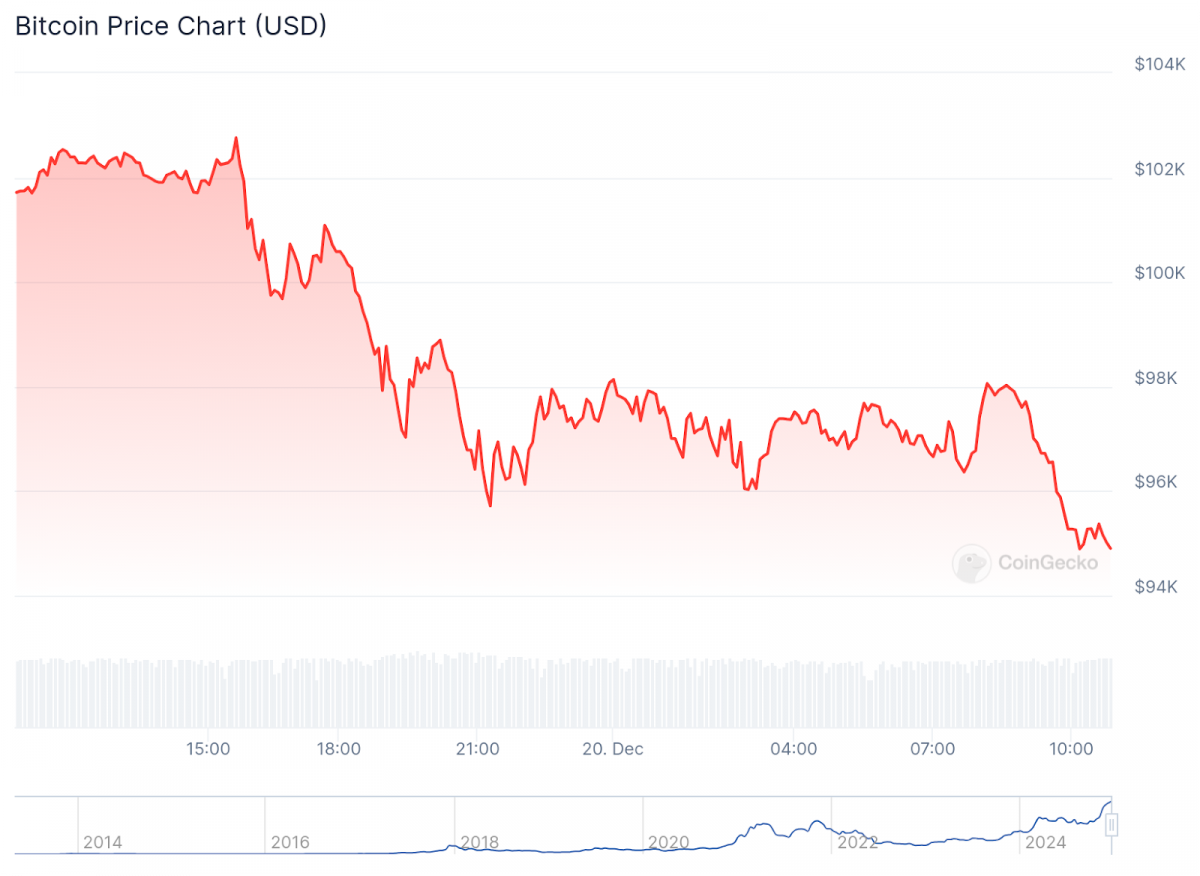

Bitcoin, which saw its price fall and settle at $94,971 at the time of writing, was the leader of the liquidation wave.

Photo: CoinGecko

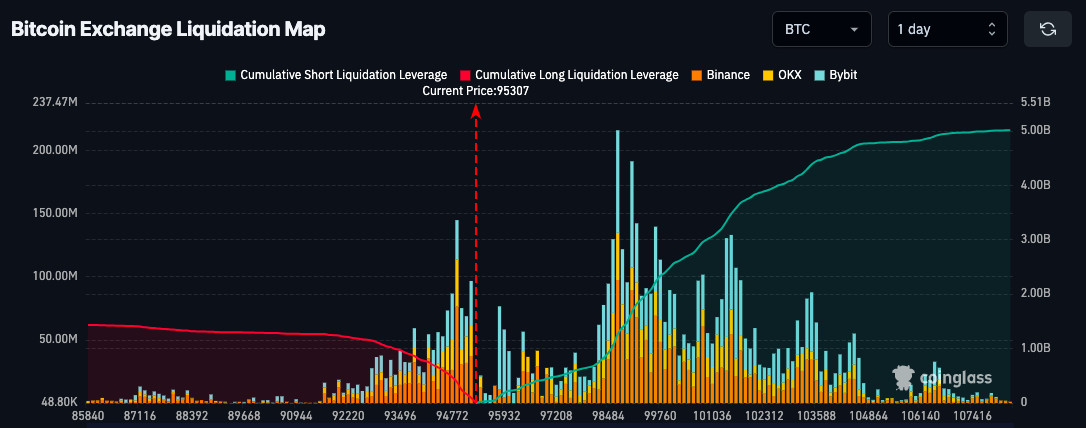

According to CoinGlass data, long positions included about $856.7 million of the $1.02 billion liquidated on December 19.

Photo: CoinGlass

This incident was the month’s second major liquidation. On December 5, Bitcoin’s price fell 5.47% below $93,000, wiping away $300 million in a matter of minutes. Days later, on December 10, more over $1.7 billion in leveraged positions were eliminated in a single day due to a wider market slump. The inherent volatility of the cryptocurrency market and the dangers of leveraged trading are both reflected in these incidents.

Caleb Franzen, a cryptocurrency market expert, said that comparable pullbacks have happened in past cycles and explained this volatility as typical behavior during a bull run. His observations show the present drop could not portend a deeper drop but rather an episodic correction characteristic of upward market trends.

Hawkish Federal Reserve Signals Contribute to Market Pressure

The cryptocurrency market is now much more complicated as a result of recent steps by the Federal Reserve. The Fed announced a quarter-percentage-point drop to its main interest rate on December 18, its third in a row. However, market confidence was tempered by its cautious approach to further cutbacks.

For risky assets like cryptocurrencies, the central bank’s decision to restrict rate cuts until 2025 has generated uncertainty. Although cryptocurrencies are increasingly being viewed as a hedge against inflation, their extreme volatility still poses a problem in developed countries, according to Ruslan Lienkha, Chief of Markets at YouHodler.

Bearish sentiment in the cryptocurrency market was fueled by the Fed’s measures that limited liquidity. However, Lienkha said that by increasing liquidity in the banking sector, quicker rate reductions could raise the value of cryptocurrencies.

Leverage Risks Are Highlighted by Long Liquidations

The risks of high-leverage trading in erratic markets are highlighted by the $856.7 million long position liquidation. In a December 19 X post, Bitcoin maximalist Fred Krueger highlighted this issue and cautioned that leverage is still the primary approach to “screw up” trading Bitcoin.

The mood is indicative of the wider dangers that leverage presents to traders, both institutional and individual. Leveraged holdings are particularly risky amid sudden changes in the market since they increase both possible gains and losses.

Expectations for the Santa Rally Despite Volatility

Some market players are still hopeful for a year-end revival in spite of the recent upheaval. The idea of a “Santa rally,” in which asset values increase during the Christmas season, has been alluded to by analysts such as Pav Hundal of Swyftx and Jamie Coutts of Real Vision.

Hundal described today’s state of situation as “short-term angst,” implying that the bullish mood of the previous month would reappear. He said that more volatility or a rebound might be fueled by the market’s response to recent events, such as Federal Reserve policies and conjecture around Donald Trump’s upcoming administration.

In line with past trends when pullbacks during bull runs were followed by higher highs, Coutts and other analysts see the current decline as a possible buying opportunity. During the last Bitcoin bull run, Franzen noted nine such drops that preceded new all-time highs.

Market Expectations Are Shaped by Political Factors

Beyond current market conditions, cryptocurrency investors are paying attention to Donald Trump’s coming inauguration as the 47th president of the United States in January 2025. A U.S. Bitcoin strategic reserve is one of the possible regulatory changes that market players are thinking about.

Hundal said that when businesses consider expectations for crypto regulation and more general economic measures, there would likely be volatility around Trump’s administration. In the upcoming months, this uncertainty may cause the cryptocurrency market to fluctuate even more.

Some analysts advise caution, while others see this pullback as a normal part of a larger bull market. The next stage of cryptocurrency price changes will probably be shaped by the interaction of market mood, political events, and Federal Reserve policy.

Traders and investors must balance the possible benefits of engaging in an erratic yet quickly changing market against the hazards of leveraging positions when faced with uncertainty. It remains to be seen if the market undergoes a protracted decline or if the expected Santa rally occurs. The takeaways from this incident, however, are unmistakable: risk management and planning are crucial for surviving in the volatile cryptocurrency market.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria d’Este

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.