Table of Contents:

Risks and Challenges in DeFi

Common risks associated with DeFi investments

Regulatory and security challenges

Decentralized finance (DeFi) has taken the world by storm with its promise of financial freedom, flexibility, and transparency. But while DeFi has opened new doors, it also presents unique risks and challenges. These obstacles might not seem apparent at first glance but can lead to pitfalls for those diving in unprepared. If you’re considering venturing into DeFi or are already involved, understanding these challenges is crucial. Let’s dive into the most common risks, the regulatory and security concerns, and some best practices for protecting yourself along the way.

Risks and Challenges in DeFi:

Even though DeFi offers exciting opportunities, the landscape isn’t without its rough terrain. Here are some of the primary challenges you might encounter.

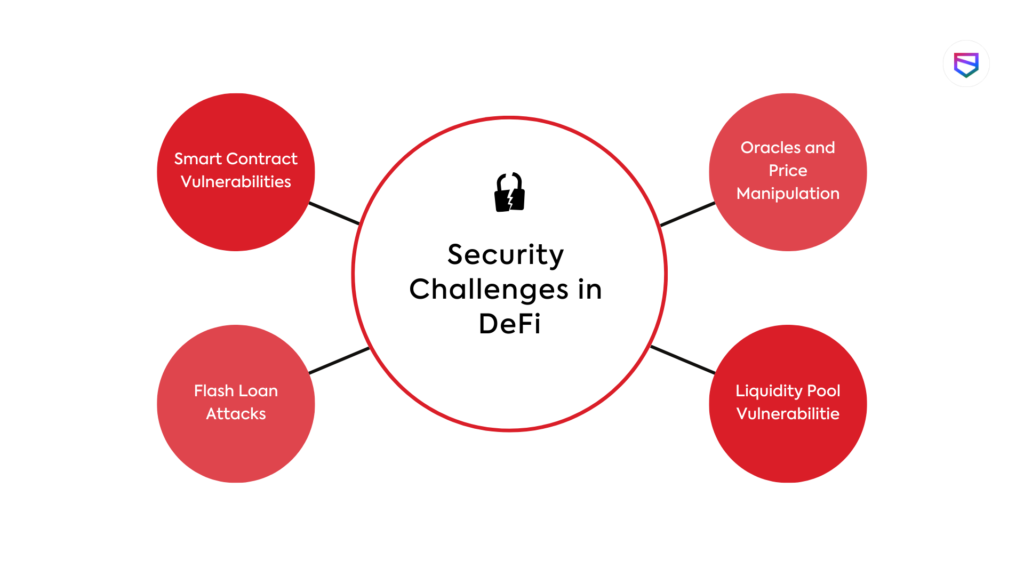

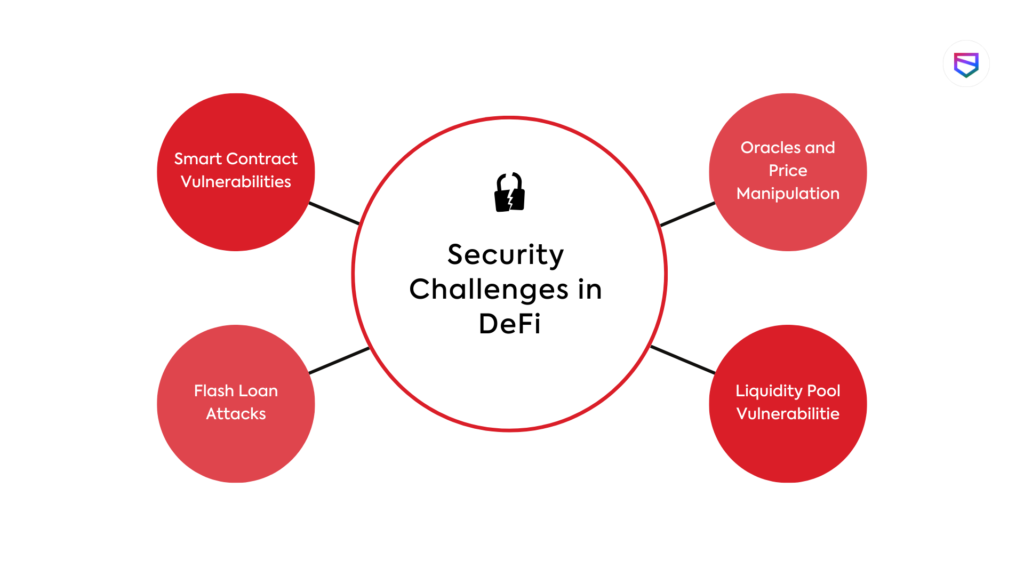

1. Smart Contract Vulnerabilities:

Smart contracts are essential to DeFi’s functioning, but they are not foolproof. Smart contracts are self-executing, meaning once they’re set in motion, there’s no going back. Unfortunately, bugs or vulnerabilities in these contracts can be exploited by malicious actors, causing financial loss. Unlike traditional finance, where errors can often be reversed, DeFi is immutable, meaning transactions cannot be changed or undone. This immutability is great for transparency but risky when bugs exist.

2. Liquidity Issues:

Liquidity is the lifeblood of any financial ecosystem. DeFi relies heavily on liquidity pools, where users lock their assets to facilitate trading and earn rewards. However, a sudden drop in liquidity, sometimes called a “liquidity crisis,” can make it difficult for users to access or trade their funds. Low liquidity can also result in drastic price swings, which can impact an investor’s returns.

3. Market Volatility:

DeFi is largely built around cryptocurrencies, and if there’s one thing we know about crypto, it’s volatile. Prices can spike or drop dramatically in a matter of hours or even minutes. This volatility can be a double-edged sword. While it presents the potential for high returns, it also means that investments can lose value quickly, especially in the short term.

4. Lack of Consumer Protection:

In traditional finance, consumers have regulatory bodies that help protect their interests, like the FDIC or SEC in the U.S. But DeFi is still largely unregulated, meaning that if you fall victim to fraud, theft, or system failures, there may be no recourse. There are no intermediaries or insurance to cover your losses in most DeFi platforms, leaving investors to assume all the risk.

5. Complexity and Accessibility:

For many, DeFi is a challenging space to understand. Even seasoned investors need time to understand its intricacies fully. If users misinterpret DeFi protocols, they may make costly mistakes. Navigating this complex environment requires a solid understanding of blockchain, cryptocurrency, and smart contract mechanics—something many new investors might struggle with.

Common Risks Associated with DeFi Investments:

When it comes to DeFi investments, the challenges extend beyond general market issues. Here’s a look at the specific risk’s investors should watch out for.

1. Impermanent Loss:

For those participating in DeFi liquidity pools, impermanent loss is a real concern. When you provide liquidity, the value of your assets in the pool can fluctuate due to price volatility. If one asset’s price changes significantly relative to the other, liquidity providers could end up with a lower overall value than if they’d simply held onto their assets separately. Impermanent loss is common in DeFi and can lead to disappointing returns for liquidity providers.

2. Rug Pulls and Scams:

Unfortunately, the DeFi space is rife with scams. “Rug pulls” occur when developers create a token, promote it heavily, and then disappear with investors’ funds. This has happened more often than you might think in the DeFi world, as malicious actors take advantage of the lack of regulations. Always investigate projects thoroughly and look for transparency in the development team before investing.

3. Flash Loan Attacks:

Flash loans are a unique DeFi feature, allowing users to borrow large sums without collateral, provided the loan is paid back within the same transaction. However, this has opened the door to “flash loan attacks,” where hackers manipulate prices or exploit vulnerabilities to siphon off funds. Flash loan attacks have led to millions in losses on various platforms, making this a significant risk in the DeFi space.

4. Oracle Manipulation:

Oracles are tools that bring external data (like asset prices) into the blockchain, allowing smart contracts to function accurately. However, if oracles are manipulated, attackers can alter the data that DeFi protocols rely on, causing them to miscalculate and misallocate funds. In 2020, several DeFi protocols lost millions due to oracle manipulation, proving just how serious this risk can be.

5. Governance Risks:

Decentralized Autonomous Organizations (DAOs) govern many DeFi protocols, meaning that users with governance tokens can vote on changes to the platform. While this is democratic, it can also be dangerous if a malicious group gains control of the majority of votes. In such cases, they could manipulate the protocol to benefit themselves at the expense of others.

Regulatory and Security Challenges in DeFi:

While DeFi’s decentralization offers benefits, it also presents regulatory and security challenges. Here are some of the most pressing issues.

1. Lack of Regulatory Clarity:

DeFi operates in a largely unregulated space, which is a double-edged sword. On one hand, it allows for rapid innovation; on the other, it creates uncertainty. Regulatory bodies are still figuring out how to approach DeFi, with different countries considering various strategies. This regulatory gray area means that DeFi users could face sudden rule changes that impact their investments.

2. Security Breaches and Hacks:

Security is a major concern in DeFi. Due to the open-source nature of most DeFi protocols, hackers can review the code and identify vulnerabilities. DeFi platforms have fallen victim to significant security breaches, leading to substantial losses for users. As DeFi grows, it becomes a more attractive target for hackers, making security an ongoing challenge.

3. Cross-Border Regulations:

Because DeFi operates on a global scale, it’s subject to the laws of multiple jurisdictions, each with its own approach to financial regulation. For instance, what’s permissible in one country may be prohibited in another. This complexity makes it difficult for DeFi platforms to remain compliant internationally, potentially exposing users to legal risks.

4. Risk of Centralization in DeFi:

Ironically, some DeFi projects still rely on centralized elements, such as a small group of developers who control updates or decisions. This “centralization in DeFi” undermines the decentralized ideal and can lead to situations where a single point of failure threatens the entire project.

5. KYC and AML Compliance:

As governments work to enforce anti-money laundering (AML) and know-your-customer (KYC) regulations, DeFi platforms may come under pressure to comply. While this would make DeFi more secure, it also poses a challenge, as many DeFi users value privacy. A push for KYC/AML could change the way DeFi platforms operate and impact the decentralized nature that many users prize.

Mitigating Risks in DeFi:

Source: liquidloans.io

Despite these challenges, there are ways to reduce the risks of participating in DeFi. Here are some strategies to help you navigate this emerging financial space more safely.

1. Do Thorough Research:

In DeFi, knowledge is power. Always research the platform, project team, and security audits before investing. Look for protocols that are transparent about their code, and security audits, and have an active community. Staying informed about recent developments can help you avoid common scams and vulnerabilities.

2. Diversify Investments:

Don’t put all your funds into a single DeFi protocol. Diversifying across multiple projects and asset types can reduce the impact of a single failure. Spreading your investments mitigates the risk of impermanent loss, rug pulls, and other potential setbacks.

3. Use Reputable Wallets and Secure Your Private Keys:

Using a secure, reputable crypto wallet and safeguarding your private keys is essential. Consider wallets like MetaMask, Trust Wallet, or Ledger, which have proven security features. Losing access to your private keys means losing access to your funds, so always store them securely and consider using multi-factor authentication where possible.

4. Start Small and Scale Up Gradually:

If you’re new to DeFi, it’s wise to start with small investments and get a feel for the platform before making larger commitments. Many DeFi protocols have steep learning curves, and starting small allows you to familiarize yourself without taking on significant risks.

5. Stay Updated on Regulations:

Keeping an eye on regulatory developments in your country is essential, as changes in the law could impact your investments. Subscribe to updates from trusted sources, like DeFi-related news outlets or blockchain-focused legal experts, to stay informed about any changes that may affect your holdings.

DeFi is undeniably a groundbreaking development in the world of finance, offering flexibility, transparency, and access. But with these benefits come real risks. The volatility, lack of regulation, and security challenges make DeFi a high-stakes game, but with the right knowledge and precautions, it’s possible to navigate it safely. As the DeFi ecosystem continues to mature, its challenges may diminish, but staying informed and prepared remains the best approach.

Have you encountered any challenges with DeFi, or do you have tips on navigating its risks? Share your experiences in the comments below—let’s help each other make the DeFi space safer and more accessible.

Subscribe to our newsletter for the latest updates, trends, and insights—let’s navigate the world of Web3 together!