The period between 2022 and 2025 will be remembered as the tipping point before humanity entered an era of unprecedented technological acceleration. Artificial intelligence is proving to be the most transformative force of our time, with the potential to reshape industries, economies, and everyday life. Unless breakthroughs in life extension allow us to live for centuries, this is the defining technological shift of our lifetime.

The momentum behind AI is undeniable. In the first half of 2024 alone, $35 billion has flowed into AI startups, a staggering figure that doesn’t even account for the massive internal investments made by tech giants. Companies like Microsoft, Google, and Meta are securing AI infrastructure at an unprecedented scale, leading to a surge in demand for GPUs from NVIDIA, whose market cap has soared to $3 trillion.

Amidst this AI explosion, one opportunity remains largely overlooked—Crypto AI (or decentralized AI). While AI’s growth has been largely centralized, driven by a few dominant corporations, there is an urgent need to decentralize its power. Left unchecked, centralized AI will consolidate control over data, algorithms, and decision-making into the hands of a few monopolistic entities. Decentralized AI presents an alternative—a model where AI development, access, and governance are democratized, ensuring that AI remains open, fair, and accountable.

Skeptics dismiss Crypto AI as another speculative fusion of buzzwords, citing previous failed attempts to integrate blockchain into entertainment, gaming, and social media. However, the fusion of AI and blockchain represents something entirely different—a convergence of two revolutionary technologies that together unlock new paradigms in computing, trust, and accessibility.

This article marks the first installment of a three-part series that will explore the Crypto AI landscape in depth. It will examine the key sectors poised for exponential growth and provide insights into how investors and entrepreneurs can capitalize on this transformative megatrend.

The Power of Converging Megatrends

Technological revolutions are driven by secular technology trends—deep-rooted shifts that redefine entire industries. Crypto represents one such trend, fundamentally altering how we perceive and use money. Other major secular trends include the rise of cloud computing, mobile technology, and renewable energy.

However, simply following a single trend is not enough. The real breakthroughs occur when two or more secular trends converge, creating unprecedented opportunities for value creation. The fusion of AI and blockchain is one such moment—a powerful intersection where AI’s ability to process and automate combines with blockchain’s ability to create decentralized, trustless networks.

Crypto AI benefits from multiple growth drivers. Companies operating at this intersection are not solely reliant on the growth of blockchain or AI individually; instead, they gain momentum from both industries simultaneously. This dual exposure amplifies their potential for success, making them more resilient to market fluctuations. Additionally, the complexity of building in both AI and blockchain creates natural barriers to entry, reducing competition and increasing the likelihood of long-term dominance for early adopters. The convergence of these two trends also fosters groundbreaking innovations, allowing ideas from both domains to merge in ways that would be impossible within either industry alone.

The larger the market, the greater the opportunity. AI is already a trillion-dollar industry, and blockchain continues to evolve beyond financial applications. The intersection of these fields represents an entirely new frontier, one that is still in its infancy.

Why AI and Crypto Are Perfect Complements

AI and blockchain have the potential to enhance each other in fundamental ways. AI is notoriously resource-intensive, requiring vast amounts of computational power, data, and infrastructure. Blockchain, meanwhile, enables decentralized coordination, verifiable trust, and transparent governance. Together, they create a symbiotic relationship that strengthens both ecosystems.

AI benefits from blockchain’s decentralized governance and trustless infrastructure. Today’s AI landscape is dominated by centralized corporations like OpenAI, Google, and Anthropic, which control the development and deployment of cutting-edge AI models. Blockchain introduces an alternative—a decentralized framework where AI models can be trained, deployed, and monetized in an open, permissionless manner. Smart contracts ensure that AI operates transparently, reducing biases and preventing manipulation by centralized entities. Additionally, blockchain-based token economies create powerful incentives for AI development, allowing contributors to be rewarded fairly.

Crypto benefits from AI’s ability to improve user experience, security, and automation. AI-powered interfaces make blockchain applications more accessible by allowing users to interact with crypto ecosystems through natural language instead of complex cryptographic keys and transactions. AI enhances blockchain security by detecting fraud, monitoring transactions, and optimizing network efficiency. Smart contracts, powered by AI automation, can execute complex agreements with improved precision, reducing human error and inefficiencies.

The integration of AI and blockchain is not just a speculative trend—it is an inevitable technological evolution that will redefine industries.

The Lessons of the Past: Why Crypto AI Is Different

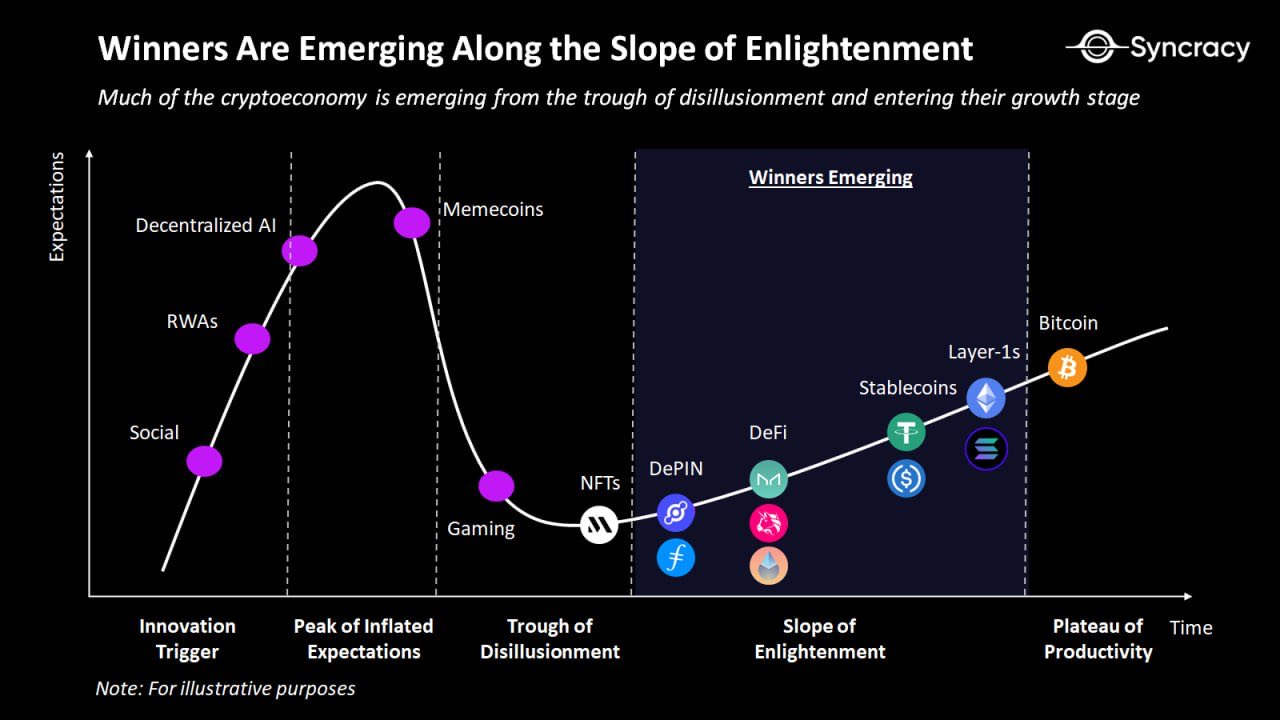

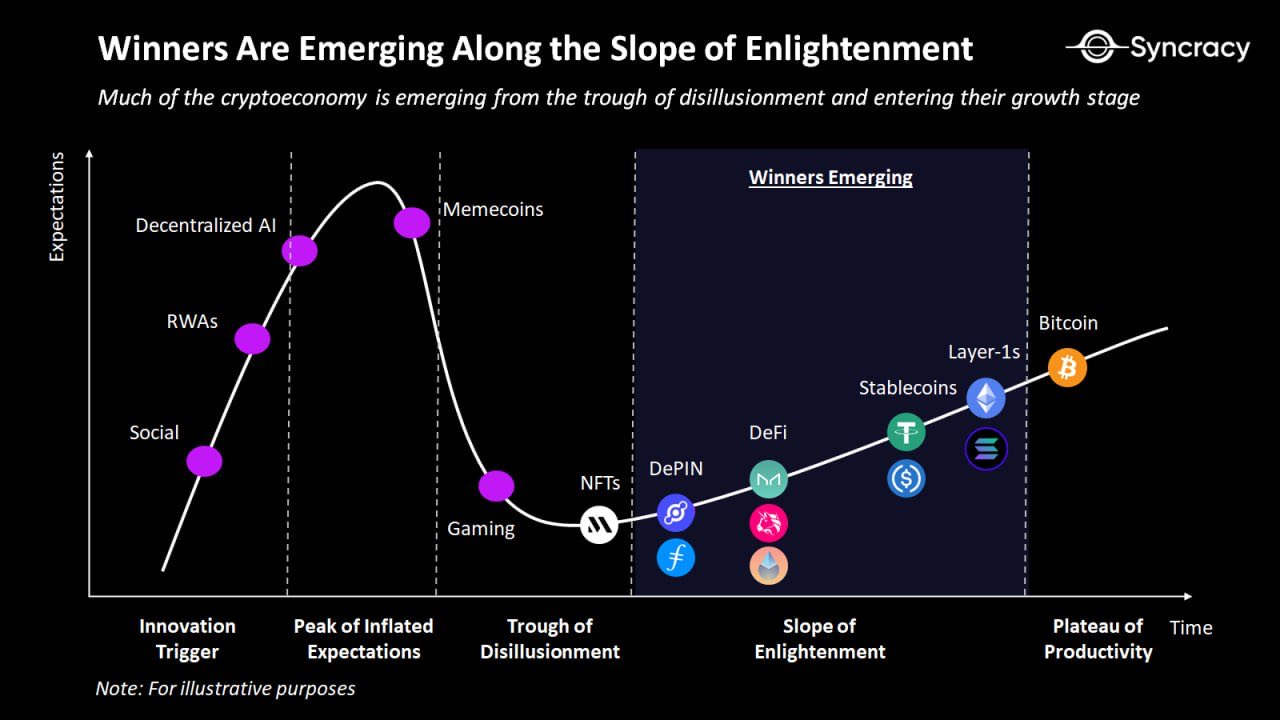

Crypto has witnessed multiple cycles of hype and disillusionment, with some trends fizzling out while others established lasting dominance. To understand why Crypto AI is different, it is important to examine two key trends from the past: NFTs and DeFi.

The rise of NFTs in 2021 was driven largely by speculation rather than real-world utility. While NFTs offer legitimate use cases in digital ownership and the creator economy, they lacked the backing of a strong secular technology trend outside of crypto. Without integration into a broader technological shift, NFTs struggled to sustain their initial momentum.

In contrast, DeFi succeeded because it intersected with fintech, an industry worth trillions of dollars. By offering decentralized alternatives to banking, lending, and asset management, DeFi provided tangible financial solutions, ensuring its long-term relevance. Today, the total stablecoin market cap is at an all-time high of $170 billion, with $82 billion locked in DeFi protocols.

Crypto AI is uniquely positioned for sustainable growth because it benefits from two unstoppable trends: AI and blockchain. Unlike NFTs, which were primarily driven by speculation, and unlike DeFi, which was constrained to financial applications, Crypto AI represents a fundamental technological shift with widespread applications across multiple industries.

Why AI Needs Crypto: The Token Revolution

One of the biggest challenges in AI development is its high cost and centralization. Unlike traditional software, which scales at near-zero cost, AI requires massive computational resources and continuous investment. Currently, AI development is dominated by well-funded corporations with access to specialized hardware and talent.

Crypto offers a solution through tokenized incentives and decentralized funding models. Tokens allow AI to be built and maintained in a decentralized manner, rewarding contributors through blockchain-based incentive structures. Instead of relying on venture capital or corporate funding, open-source AI projects can be financed through tokenized networks, ensuring they remain independent and accessible.

Tokens also enable the creation of global AI infrastructure. Right now, AI compute power is concentrated within tech giants. Blockchain-based GPU marketplaces can unlock unused computing resources from around the world, significantly reducing costs and increasing accessibility. By decentralizing AI infrastructure, crypto ensures that AI remains a public good rather than a corporate monopoly.

Why Now Is the Right Time for Crypto AI

Timing is critical in emerging technologies. The best investment opportunities arise when an innovation is either in its early stages or recovering from the trough of disillusionment before mainstream adoption. Many believe that Crypto AI has already peaked, but the data tells a different story.

The total market cap of Crypto AI tokens is only $30 billion—just 2.9% of the total altcoin market. Compared to smart contract platforms, which have a combined valuation of nearly $600 billion, Crypto AI is still vastly undervalued. If decentralized AI captures just 10% of the projected $1.3 trillion generative AI market by 2032, it could be worth $390 billion—13 times its current size. Even a more conservative estimate suggests a 9X increase within three years, making Crypto AI one of the most promising investment sectors of the decade.

Final Thoughts: The Future of Decentralized AI

Crypto AI is poised to be the most significant evolution within blockchain, bringing real-world utility and solving fundamental problems in AI governance, funding, and accessibility. Unlike previous speculative trends, this is a deep technological transformation with real demand and sustainable growth.

We are entering an era where AI and blockchain will become inseparable. The question is no longer if Crypto AI will succeed—it’s how big it will become.

In Part II, we will explore the key subsectors within Crypto AI, including decentralized compute, AI agents, data networks, and verifiable AI. The revolution is just beginning.