Buying Bitcoin can seem overwhelming at first, but it is easier than you might think. With the rise of digital currencies, many people want to know how to buy Bitcoin and invest in this exciting market.

This guide will walk you through the steps you need to follow, from choosing the right platform to understanding how to store your Bitcoin safely.

Key Takeaways:

You can buy Bitcoin using popular crypto exchanges like Binance, Coinbase, and OKX, as well as payment methods such as credit cards, PayPal, and Bitcoin ATMs for easy transactions.Buying Bitcoin involves selecting a crypto platform, creating an account, depositing funds, placing an order, and finally purchasing BTC using market or limit orders.You can store Bitcoin safely using hardware wallets for offline security, software wallets for ease of access, and paper wallets for long-term storage.

How to Buy Bitcoin: Step-by-Step Guide

Buying Bitcoin may seem tricky at first, but it’s quite simple once you know the steps. Let’s walk through the process:

Step 1: Choose a Crypto Exchange or Trading Platform

There are many crypto exchanges and apps out there, each with its own trading features. Some popular ones include Binance, Bybit, MEXC, OKX, and Coinbase.

When picking an exchange, consider factors like fees, security, supported cryptocurrencies, and whether it’s legal in your country. It’s like choosing a bank – you want one that’s trustworthy and meets your needs.

Also, ensure that the crypto trading platform accepts the payment methods that you want. Some allow you to use credit cards, while others may only support bank transfers. Also, search for an exchange with an easy-to-use interface and responsive customer service. If you still need more assistance, you can check our detailed guide on the best crypto exchanges in the world.

Step 2: Create an Account and Deposit Fiat or Crypto

Once you’ve chosen an exchange, it’s time to set up your account. This process is similar to opening a new bank account. You’ll need to provide some personal information and verify your identity. This is called the KYC procedure. This step is important to follow anti-money laundering rules.

After your account is set up, you’ll need to add money to it. This is called making a deposit. You can usually do this with regular money (also called fiat currency) like USD, EUR, INR, or GBP. The crypto exchanges also let you deposit other cryptocurrencies if you already have them on another crypto wallet.

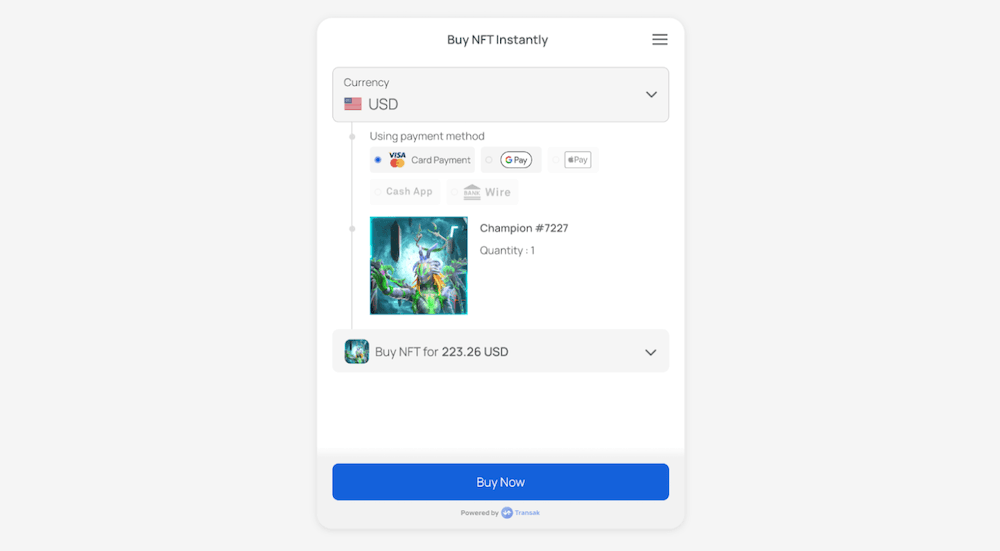

Usually, you’ll need to utilize a credit card or link a bank account to make a fiat deposit. You can also use third-party payment providers like MoonPay, Simplex, Banxa, Google Pay, Apple Pay, and more.

Remember, each exchange has its own rules about minimum deposit amounts and fees. Make sure you understand these before you start. It’s always wise to start with a small amount until you’re comfortable with how everything works.

Step 3: Place a Buy BTC Order

Once your account has funds in it, you can place an order to buy Bitcoin (often abbreviated as BTC).

There are usually two main ways to buy:

Market Order: This is like saying, “I want to buy Bitcoin right now at whatever the current price is”. It’s quick and simple, but the price might change slightly between when you click “buy” and when the order goes through. This is generally called price slippage and is very little or often negligible. It depends on exchange liquidity and trading volume.Limit Order: This is more like saying, “I want to buy Bitcoin, but only if the price reaches X amount”. You set the price you’re willing to pay, and the order will only go through if Bitcoin reaches that price. This can be useful if you’re trying to get a specific deal, but it might take longer or not happen at all if the price doesn’t reach your set amount.

When you’re ready to buy, you’ll need to figure out how much Bitcoin you want. You do not have to buy an entire Bitcoin; you can purchase parts of one. For example, you can choose to buy $100 worth of Bitcoin, regardless of how many Bitcoins you receive.

Once you’ve made these options, double-check everything and finalize your purchase. The exchange will process your order, and you will shortly become a Bitcoin owner.

Step 4: Transfer Bitcoin to an External Wallet

After buying Bitcoin, it is highly suggested that you transfer it to an external Bitcoin wallet. Keeping your Bitcoin on an exchange exposes it to possible threats like hacking or platform failure. An external wallet provides increased protection for your Bitcoin and gives you complete control over your assets.

There are several sorts of wallets accessible, including hardware wallets, software wallets, and paper wallets. To send Bitcoin, you’ll only need the Bitcoin deposit address from your external wallet.

How to Buy Bitcoin (BTC) with PayPal

Currently, PayPal allows certain users, specifically those with PayPal Balance accounts and eligible business account holders, to buy cryptocurrency, including Bitcoin.

To purchase Bitcoin through PayPal, you will need to follow these simple steps on the PayPal mobile app.

Step 1: First, open the app and go to the “Accounts” section. From there, select “Crypto”. This will take you to the cryptocurrency section, where you can start your Bitcoin purchase.

Step 2: Next, tap on “Buy” to initiate the transaction. You’ll then be prompted to choose the amount of Bitcoin you wish to purchase. PayPal gives you several options regarding the frequency of your purchase. You can decide if you want it to be a one-time transaction or if you’d prefer recurring purchases.

The frequency options include daily, weekly, biweekly, or monthly purchases. If you’re not looking for a recurring purchase, it will default to a one-time buy.

Step 3: Once you’ve selected the amount and frequency, you’ll be asked to choose a starting date for your transaction. After doing that, tap “Confirm” to proceed to the next step. At this point, you’ll be shown a summary of your order, where you can review all the details. If everything looks correct, tap “Next” to move forward.

Step 4: After confirming your order, you’ll need to select your payment method. PayPal allows you to use the payment options linked to your account, such as your bank account or credit card. Once you’ve chosen the preferred method of payment, tap “Next” to authorize the transaction.

Step 5: Finally, you’ll be asked to confirm and schedule the purchase. Tap “Authorize and Schedule”, and the transaction will be finalized. If you opt for a one-time purchase, your Bitcoin will be purchased immediately. If you selected a recurring option, the app will schedule future purchases according to the frequency you chose.

Note: Many cryptocurrency exchanges like Binance, OKX, and Bybit also allow you to buy Bitcoin using PayPal through their P2P marketplace.

How To Buy Bitcoin With a Credit Card

Many cryptocurrency exchanges allow users to purchase Bitcoin using credit cards. This option provides ease of use, as most people are familiar with credit card payments.

The process is straightforward. First, make sure the exchange accepts credit card payments. Binance and KuCoin are the two most popular platforms. Then, enter your credit card details and link them to the exchange, deposit funds into your exchange account, and place a buy order for Bitcoin.

Be aware that using a credit card to buy Bitcoin often incurs higher fees compared to bank transfers or other forms of payment. Some platforms might charge a percentage of the transaction amount as a fee.

Different Ways to Buy Bitcoin (BTC)

Buying Using Bitcoin ATMs

Bitcoin ATMs offer a straightforward method to purchase Bitcoin using cash or, in some cases, a debit card. While these machines function similarly to traditional ATMs, the process is somewhat different.

Here’s a detailed guide on how to navigate a crypto ATM effectively.

Step 1: Found a Bitcoin ATM in a Nearby Area

Your first task is to find a Bitcoin ATM. Websites like CoinATMRadar can be helpful. Ensure that you check the transaction fees and limits beforehand, as these can vary by machine.

Step 2: Set Up Your Wallet

Before making a purchase, you need a crypto wallet capable of receiving Bitcoin. This could be a software or hardware wallet, depending on your preference for security. Have your wallet’s QR code or public key accessible, as the machine will need this information to transfer your Bitcoin.

Step 3: Input Your Purchase Amount

Select the “Buy Bitcoin” option and specify the cash amount you wish to convert into Bitcoin. The ATM will display the current exchange rate and applicable transaction fees, allowing you to review the total cost before proceeding.

Step 4: Scan Your Wallet Address

The next step involves scanning your wallet’s QR code using the ATM’s scanner. This step ensures the Bitcoin is sent directly to your wallet. Double-check the wallet address for accuracy, as Bitcoin transactions are irreversible.

Step 5: Insert Cash

With your wallet address confirmed, proceed to insert cash into the machine. It automatically converts the cash into Bitcoin based on the prevailing exchange rate. Be aware that transaction fees for Bitcoin ATMs can be significant, often ranging from 5% to 10%, which is much higher than online exchanges.

Step 6: Confirm Your Transaction

After cash insertion, finalize your purchase by pressing the “Buy” or “Confirm” button. The machine will process the transaction, which may take several minutes to complete due to the Bitcoin network’s congestion.

Step 7: Verify Receipt in Your Wallet

Once the transaction is processed, the purchased Bitcoin will be sent to your wallet. Depending on network activity, it might take some time for the coins to appear. After confirming that the transaction is complete, store your Bitcoin securely in your wallet.

Buy Bitcoin on Cryptocurrency Exchanges

Cryptocurrency exchanges are the most common platforms used to buy Bitcoin. However, not all exchanges function the same way. You can purchase Bitcoin on centralized exchanges, peer-to-peer (P2P) platforms, decentralized exchanges (DEXes), and even through mainstream brokerages.

Centralized Exchanges

Centralized exchanges (CEXs) like Binance, Coinbase, OKX, KuCoin, Bybit, and Kraken are popular choices for purchasing Bitcoin.

These platforms act as intermediaries, providing you with a user-friendly interface and advanced security features. Although convenient, they require you to trust the platform with your funds and personal data. This means they are the custodial crypto platforms.

Peer-to-Peer (P2P) Platforms

P2P platforms, such as Paxful, mean buying Bitcoin person-to-person without any middleman. These platforms act as facilitators but don’t control the transaction.

You and the seller agree on terms, and the transaction is processed without intermediaries. P2P platforms offer greater privacy but may require more caution due to the direct interaction with other individuals. This entire P2P process is based on the “Escrow” system.

Decentralized Exchanges (DEXes)

On decentralized exchanges like Uniswap or PancakeSwap, you can buy Bitcoin without a centralized authority. DEXes operate on smart contracts and allow for direct trading between you and another party.

These exchanges provide higher privacy and reduce the risk of hacking, but they can be more complex to navigate, especially if you are a beginner.

Mainstream Brokerages

Mainstream brokerages, like Robinhood or eToro, have also integrated Bitcoin trading into their platforms. While they don’t offer the same range of cryptocurrency features as specialized exchanges, they provide an easy way for those familiar with traditional investing to enter the Bitcoin market. However, many of these platforms limit your ability to withdraw Bitcoin to external wallets.

How to Store Bitcoin

After buying Bitcoin, ensuring its safe storage is essential. Various storage methods are available, each providing different levels of security and ease of access.

Hardware Wallets: Among the safest ways to store Bitcoin are hardware Bitcoin wallets or cold wallets. These devices securely store your private keys offline. Well-known examples include Ledger Nano X and Trezor Safe 5, making them suitable for long-term holders of Bitcoin.Software Wallets: Software wallets, often referred to as hot wallets, are applications that can be installed on your computer or smartphone. They offer greater convenience but are somewhat less secure than hardware wallets, as they are connected to the internet. Many cryptocurrency exchanges provide built-in software wallets, yet using an independent non-custodial wallet like MetaMask or Trust Wallet is generally a safer choice.Paper Wallets: Paper wallets consist of printed documents that contain your public and private keys. While they are highly secure against online threats, they can be vulnerable to physical damage or loss. These wallets are best suited for long-term storage but require careful management to prevent mishaps. You can generate paper wallets using software programs like BitAddress.

How to Sell Bitcoin

Selling Bitcoin is similar to the process of buying it. To sell, you’ll need to transfer your Bitcoin to an exchange that allows selling. Most of the major exchanges support both buying and selling functions.

Once your Bitcoin is on the exchange, you can place a sell order. You have two options: a market order or a limit order, just like when buying Bitcoin. A market order allows you to sell Bitcoin instantly at the current price, while a limit order allows you to set the price at which you want to sell.

After the sale is complete, you can withdraw the funds in your local currency. This can be done through bank transfers or other supported withdrawal methods.

Conclusion

To sum up, knowing how to buy Bitcoin is important for anyone wanting to invest in cryptocurrency. You can easily purchase Bitcoin by following the steps in this guide and choosing the right platform.

There are many ways to buy Bitcoin, like using credit cards, bank transfers, or PayPal, so you can find what works best for you. It’s also essential to know how to keep your Bitcoin safe after buying. Hardware wallets offer the best protection, while software wallets are easier for quick access.

FAQs

What is Bitcoin?

Bitcoin (BTC) is a decentralized digital currency that allows peer-to-peer transactions without the need for intermediaries, such as banks. It operates on a public ledger called the blockchain.

Who created Bitcoin?

Bitcoin was created in 2008 by an anonymous person or group using the pseudonym Satoshi Nakamoto.

How does Bitcoin work?

Bitcoin is a digital currency that functions through a technology called blockchain. This is a public record that keeps track of every transaction made with Bitcoin, ensuring everyone can see it while keeping users anonymous. When you send Bitcoin, your transaction is shared with the entire network of users.

To confirm the transaction, special users called miners use powerful computers to solve complex problems. Once they solve these problems, the transaction is approved and added to a block of other transactions. This block then connects to previous blocks, forming a chain—hence the term “blockchain”.

Bitcoins are created through mining, where miners are rewarded with new coins for their efforts. This process also helps protect the Bitcoin blockchain or network from fraud. By combining blockchain technology and mining, Bitcoin operates without needing a central authority, making it a decentralized currency.

How much Bitcoin should I buy?

When considering how much Bitcoin to invest in, it is wise to begin with a modest amount. Many financial experts recommend that investors allocate 5% to 30% of their total investment funds to cryptocurrencies like Bitcoin. For instance, if you have $1,000 set aside for investment, starting with $50 to $300 can be a sensible approach, depending on your comfort with risk.

How much is one Bitcoin worth?

Bitcoin is valued at around $65,473.98, but this figure can change rapidly. To obtain the most accurate and current price, it’s advisable to check CoinMarketCap.

Is Bitcoin a good investment?

Investing in Bitcoin can offer high returns, but it also involves significant risks due to its price volatility. Historically, Bitcoin has demonstrated strong long-term growth potential; however, its short-term price can vary dramatically.

How many Bitcoins are there?

The total supply of Bitcoin is capped at 21 million coins. Currently, most of these (over 19.76 million) have been mined, and the rest will be gradually released through mining rewards.

Is Bitcoin legal?

Yes, Bitcoin is legal in most countries. In the United States, it is treated as a form of property rather than currency. This means that transactions involving Bitcoin are subject to capital gains tax, similar to other assets.