As Babylon prepares for its eagerly awaited token generation event (TGE), the focus is on its pricing strategy and post-launch performance. With a unique model for non-custodial BTC staking and over 3.8B USD in TVL, Babylon enters the modular infrastructure arena alongside EigenLayer, Solayer, and Pendle – poised to unlock new value but also facing the pressure to deliver immediately.

Highlights of Babylon

Babylon’s most unique feature is its non-custodial Bitcoin staking mechanism: BTC holders can stake their Bitcoin directly on the Bitcoin network without going through third parties or centralized bridges.

Learn more: What is Babylon?

In essence, Babylon transforms Bitcoin into a “security layer” for the PoS ecosystem while also building a liquidity hub to channel BTC into DeFi. At the Genesis phase, Babylon Chain aims to integrate with multiple blockchains such as Osmosis, Cosmos Hub, and Sei.

Currently, Babylon’s total value locked (TVL) exceeds 3.8 billion USD, accounting for approximately 80% of the total TVL within the Bitcoin ecosystem.

Prior to the rise of Babylon, YZI Labs had already been actively supporting liquid staking initiatives like Kernel DAO. Even CZ has repeatedly highlighted this narrative. These factors have helped Babylon stand out as a leading player in this emerging space.

Babylon’s TVL – Source: DefiLlama

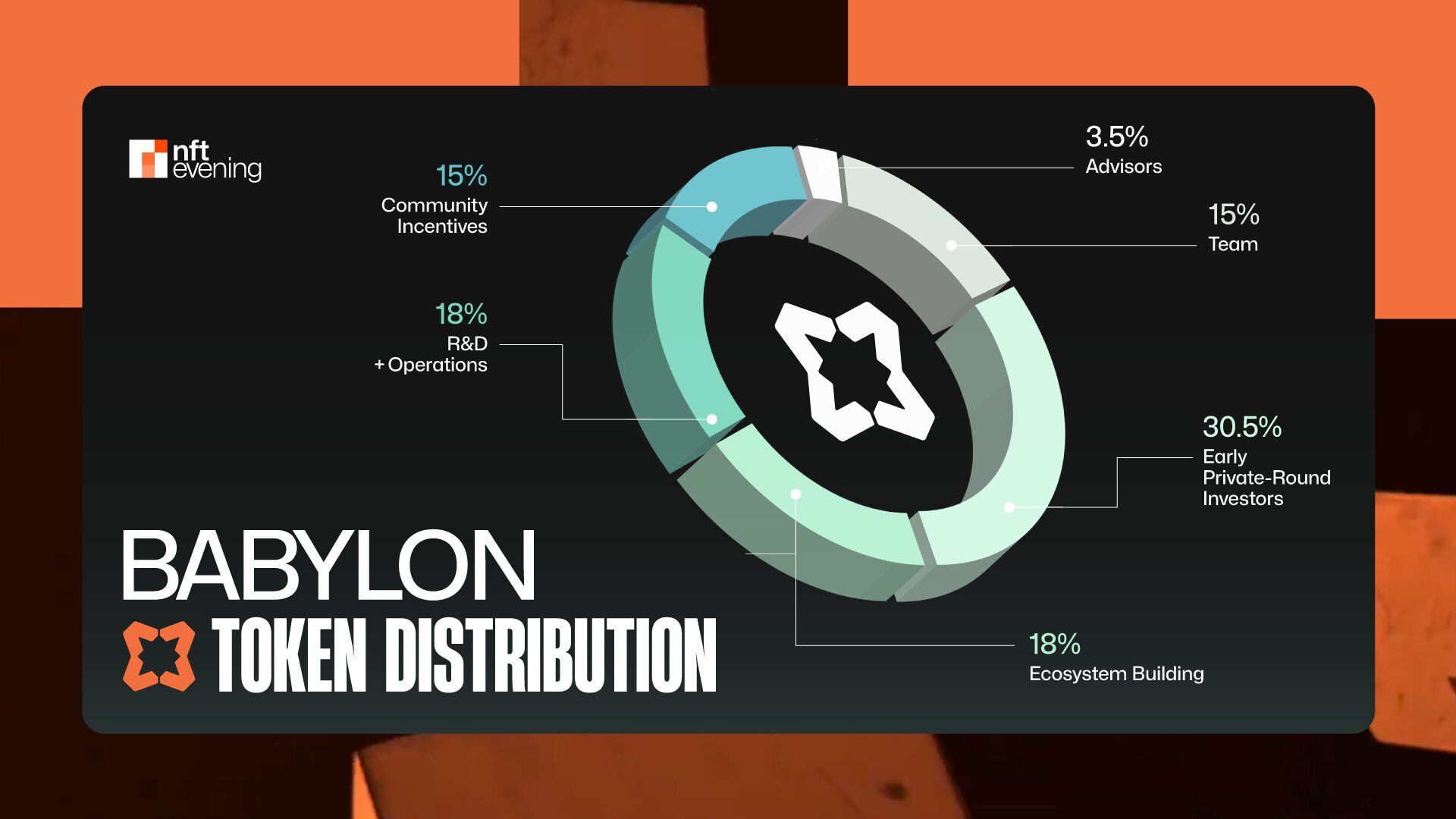

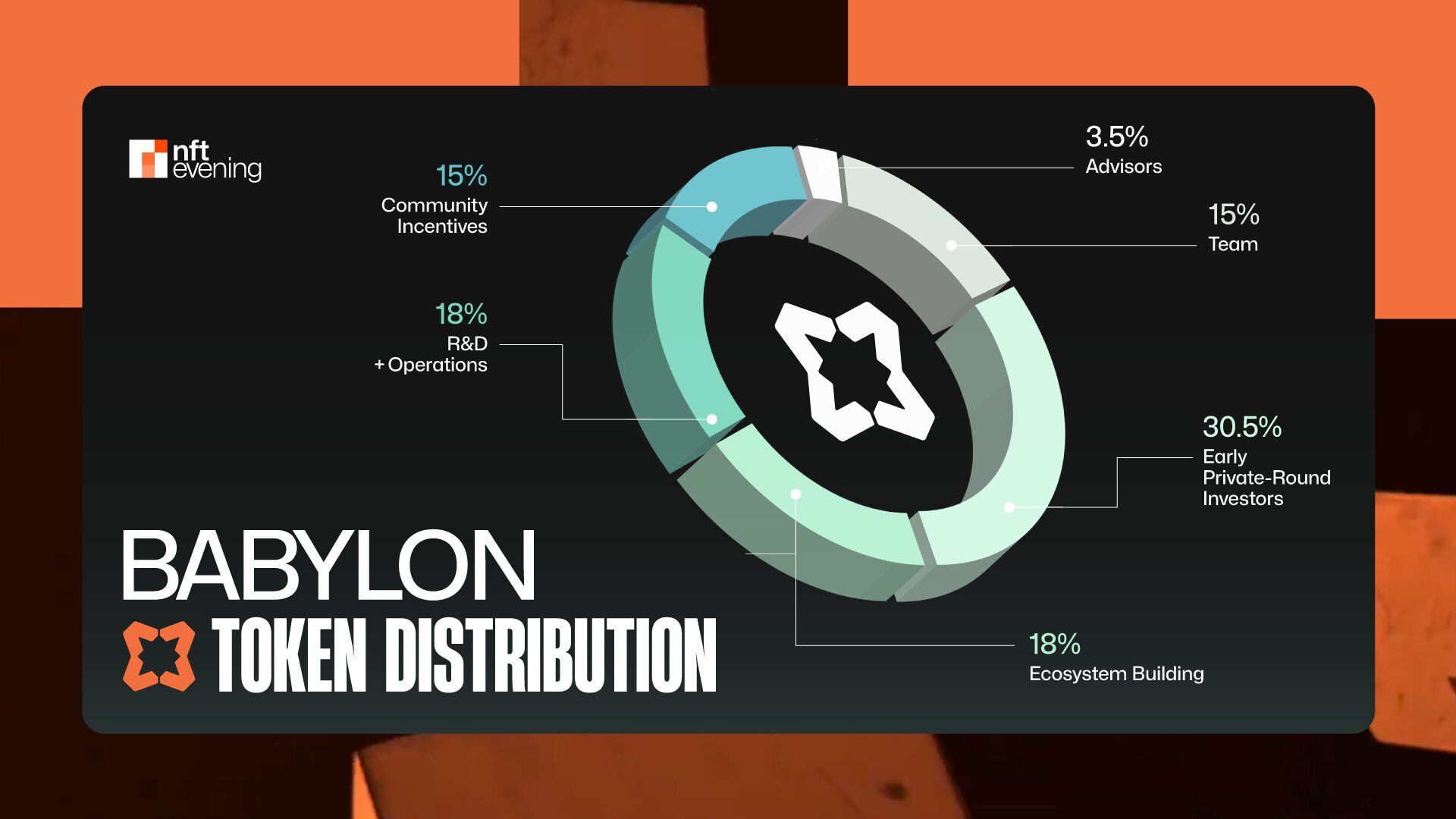

Babylon Tokenomics

Token Allocation

Early Private Round Investors: 30.5%Ecosystem Building: 18%R&D Operation: 18%Team: 15%Community Incentives: 15%Advisor: 3.5%

Babylon Tokenomics

The initial circulating supply is 2,294,036,491 tokens (22.9% of the total supply), which is a relatively high percentage and could create sell pressure.

BABY Price Prediction

Market Comparison

Babylon is not alone in the mission to unlock the foundational asset value for other blockchain networks. Several other notable infrastructure projects, such as EigenLayer EIGEN, Solayer LAYER and Pendle PENDLE are also working toward similar goals of shared/reused security and interchain connectivity.

Babylon is not alone in the mission to unlock foundational asset value across networks. Other prominent infrastructure projects aiming to enable shared or reusable security and cross-chain connectivity include EigenLayer, Solayer and Pendle.

Market Comparison

Babylon vs EigenLayer

EigenLayer leverages Ethereum’s massive staked capital (currently over 7 billion in TVL) to serve as a “shared security layer” for multiple applications, eliminating the need for each app to issue its own staking token. Both EigenLayer and Babylon are considered pioneers of the “restaking” and shared security movement in their blockchain space.

However, there is a key distinction: EigenLayer targets the Ethereum staking community, while Babylon attracts Bitcoin holders into the DeFi ecosystem. Ethereum already has a rich DeFi and application landscape that can naturally integrate restaking. In contrast, Babylon opens up a new market for Bitcoin but must convince independent PoS chains to join its network.

Babylon currently trails EigenLayer in TVL, with 57,000 BTC versus an ETH equivalent of 4.4 billion USD on EigenLayer. Nonetheless, Babylon still has significant growth potential due to Bitcoin’s vast untapped liquidity.

Babylon vs Solayer

Solayer represents a new direction in the modular security space, offering a “modular security layer” for appchains. The project launched its LAYER token via Binance Launchpool in March 2025, and shortly after listing, the token peaked at around 1.15 USD before correcting to the current range of 0.42 to 0.45 USD.

With a total supply of 1 billion tokens and an initial circulating supply of over 220 million tokens, Solayer currently holds a circulating market cap of approximately 370 million USD, while its FDV hovers around 1.5 USD–1.7 USD billion. Although this valuation is not high compared to other infrastructure projects, it reflects a degree of market caution toward the modular security narrative via staking.

Babylon vs Pendle

Pendle, on the other hand, does not focus on security but has gained prominence in the yield optimization segment. This is a direction that Babylon could potentially expand into over the long term – once a significant amount of BTC is staked via Babylon, derivative products based on BTC yield could see meaningful growth.

As for the token, PENDLE has seen tremendous growth, rising from around 0.10 USD in 2023 to a peak of over 7.50 USD in April 2025, with a current circulating market cap exceeding 1.1 billion USD. Pendle is considered a prime example of the new generation of DeFi protocols, where capital efficiency is a core value proposition.

Babylon has raised 70 million USD from Paradigm and a total of 88 million USD across multiple seed and strategic rounds from investors including Polychain, Binance Labs, Galaxy, Framework, and Hashkey. If 30.5% of tokens are allocated to investors, the implied fundraising valuation suggests a private round price of around 0.028 USD per BABY.

With over 4 billion USD in TVL (57,000 BTC) , Babylon has already surpassed both Solayer and Pendle in real traction.

Babylon Price Prediction

Thus, upon listing on Binance, users are anticipating a 3x–5x multiple over private round pricing, translating to an FDV between 840 million and 1.4 billion USD. At a public price between 0.084 USD and 0.14 USD, Babylon’s circulating market cap would still be within a reasonable range compared to top-tier infrastructure projects like EigenLayer, Lido, and Solayer.

It’s also possible that Babylon could follow the same path as many highly anticipated infrastructure projects that saw sharp declines after listing. Even EigenLayer, considered the flagship of the restaking narrative, has dropped more than 85% from EIGEN’s all-time high.

EIGEN’s price – Source: CoinGecko

However, an alternative outcome remains entirely plausible: BABY could gain strong momentum right after its TGE, especially if Babylon chooses to list it at an FDV and price exploration similar to Solayer’s.

LAYER’s price – Source: CoinGecko

Conclusion

Babylon enables non-custodial BTC staking, positioning Bitcoin as modular security for PoS chains. With over 57,000 BTC staked (TVL 4.2B USD), it has already outpaced peers like Solayer and Pendle in real traction.

BABY’s 0.084 USD – 0.14 USD range shows strong upside, but short-term risks remain. Babylon must prove its utility fast to avoid sell-offs and secure long-term value this cycle.

Read more: Binance Introduces Babylon (BABY) on HODLer Airdrops Program