Victoria d’Este

Published: March 03, 2025 at 12:05 pm Updated: March 03, 2025 at 12:05 pm

Edited and fact-checked:

March 03, 2025 at 12:05 pm

In Brief

Bitcoin dipped under $80K before rebounding to $93K, fueled by Trump’s crypto reserve news and ETF inflows. Ethereum struggles with ETF delays, while TON sees USDT growth but faces a token unlock.

Alright, so the long-feared crash into the 80s DID happen. Bitcoin got absolutely smacked, dipping under $80K for a hot second before rebounding like a boxer who took a nasty hit but refused to stay down.

BTC/USD 4H Chart, Coinbase. Source: TradingView

The bounce was violent – straight back to $93K – but then, surprise surprise, it hit a wall right at the 50-period moving average on the 4H chart (see the screenshot). RSI was first overbought, then cooling off. So now we’re at that awkward phase: Was this just a dead cat bounce, or is Bitcoin gearing up for another run?

So what actually moved the market?

Trump’s Crypto Reserve Bombshell

This one came out of nowhere. Trump – yes, the same guy who once called Bitcoin a “scam” – dropped the news that a U.S. crypto reserve could include BTC, ETH, SOL, XRP, and ADA. And just like that, Bitcoin shot up like it had a double espresso, dragging a few altcoins along for the ride.

Source: Donald J. Trump

The move liquidated a ton of shorts, creating a classic short squeeze. But let’s be real – political promises and market euphoria mix about as well as oil and water. The question is, does this actually change anything long-term?

ETF Flows Finally Flip Positive

For weeks, Bitcoin spot ETFs were bleeding out, making everyone wonder if institutional money was losing interest. But boom – ARK 21Shares and Fidelity’s Bitcoin ETFs saw a $369.7M net inflow, which finally gave bulls something to work with.

Flows into the US spot Bitcoin ETFs since Feb. 18. Source: Farside Investors

Is this the start of a bigger trend? Maybe. But ETF buyers have been notoriously fickle, so let’s not pop the champagne just yet.

Swiss National Bank Dunks on Bitcoin

While Trump was busy hyping BTC, the Swiss National Bank decided to kill the vibe, saying Bitcoin is too volatile to be a reserve asset.

Source: Bitcoin Initiative

Now, coming from a country known for its ultra-conservative financial policies, this wasn’t shocking. But it did inject some short-term FUD into the market. Not that it mattered much – Trump’s narrative was the louder one, and in markets, volume wins.

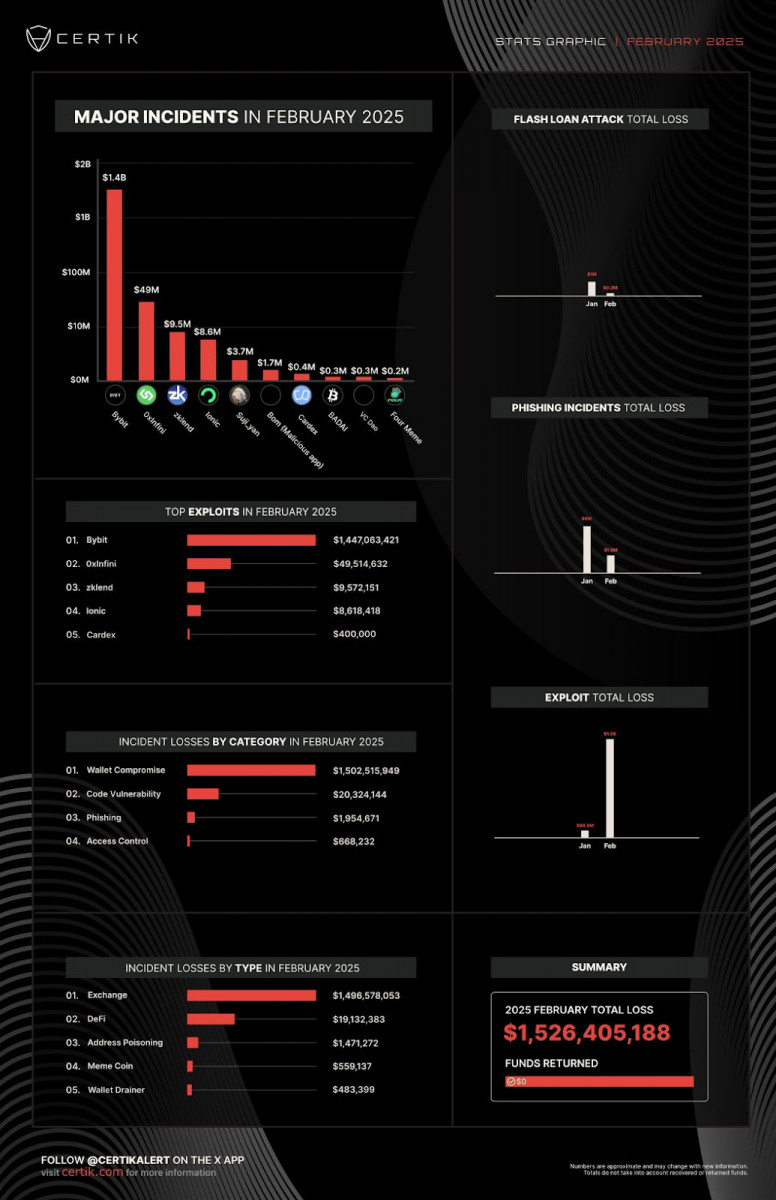

Bybit Hack: A $1.4B Disaster

As if the market didn’t have enough problems, the Bybit hack went down, with North Korean hackers allegedly laundering a massive chunk of stolen crypto.

Bybit had the largest loss in February, followed by stablecoin payment firm Infini and then the decentralized money lending protocol ZkLend. Source: CertiK

This was a brutal hit to sentiment, especially since it reignited fears about exchange security. And if history tells us anything, regulators are probably sharpening their knives, getting ready to crack down even harder.

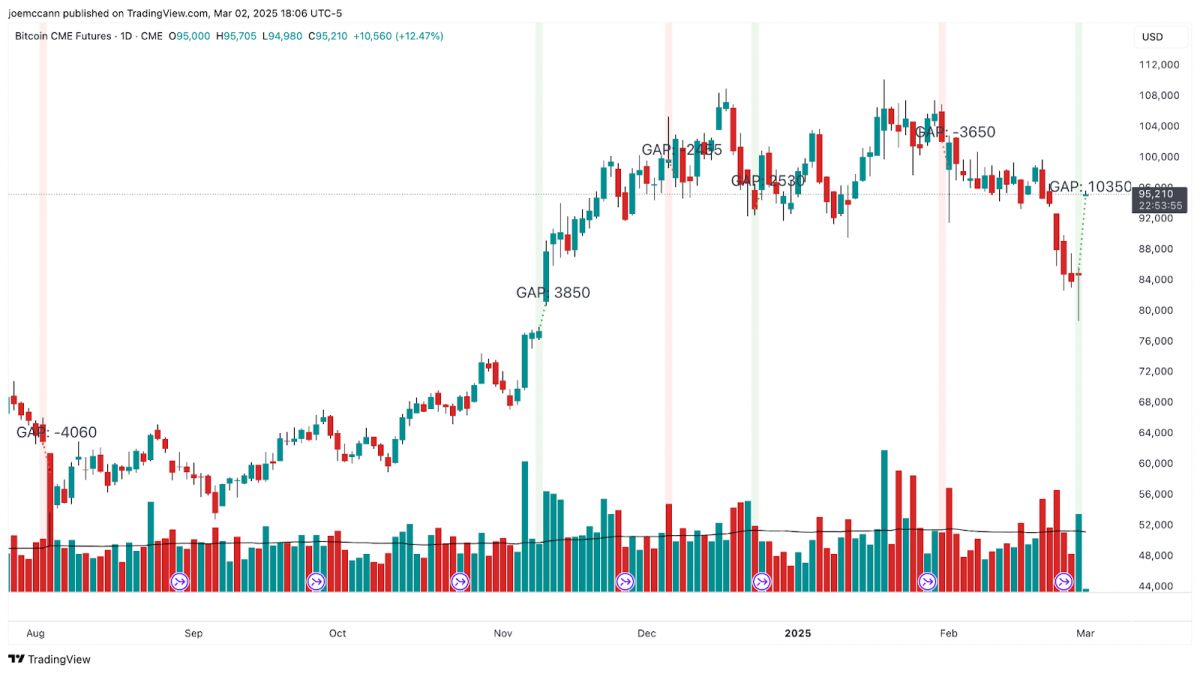

Biggest CME Gap Ever (Yep, Ever)

Here’s a fun one: a $10K gap just opened in Bitcoin CME futures – the biggest ever.

CME futures gaps. Source: Joe McCann

If you’ve been around the block, you know BTC has a habit of “filling the gap,” meaning a retrace back toward $83K–$85K wouldn’t be shocking. Traders are watching this like a hawk.

So where does this leave Bitcoin?

Sure, Bitcoin’s recovery was impressive, but let’s not pretend we’re out of the woods yet. The 50-SMA rejection isn’t a great sign, and if ETF buyers don’t keep stepping in, we could easily see another drop toward $85K. On the flip side, if Trump keeps pushing the crypto narrative and ETF demand picks up, we might be looking at another attempt to crack $95K–$100K. Either way, expect volatility.

Ethereum (ETH)

Ethereum took a similar beating to Bitcoin, plunging from highs near $2,900 down to the low $2,000s before mounting a comeback. It briefly reclaimed $2,500, but, much like BTC, it ran into trouble at the 50-period moving average on the 4-hour chart (see screenshot).

ETH/USD 4H Chart, Coinbase. Source: TradingView

RSI shot up past 60 before cooling off, suggesting some exhaustion in the bounce. At $2,381, ETH is hovering in a precarious zone, and traders are watching whether it can establish support above $2,300 or if another leg down is coming.

Now let’s dig into Ethereum’s own drama. For one, the Ethereum Foundation announced a leadership shakeup after months of grumbling from the community.

Wang pictured left and Stańczak pictured right. Source: The Ethereum Foundation

Whether this will bring fresh momentum or just more infighting remains to be seen. Meanwhile, the long-awaited Pectra upgrade is creeping closer, promising major improvements for scaling and MEV mitigation.

Source: Nic Puckrin

But, as usual, regulatory uncertainty is weighing on ETH. The SEC once again delayed a decision on Ethereum ETF options, and traders are, once again, on edge.

ETH/USD 4H Chart, Coinbase. Source: TradingView

Ethereum’s short-term fate is still tethered to Bitcoin, but these internal catalysts could give it some independence. If BTC stays stable above $90K, ETH might get another shot at $2,700 or even $3K. But if Bitcoin stumbles – or if regulators throw another wrench into the mix – Ethereum could slip back toward $2,100 or lower. Either way, expect more turbulence ahead.

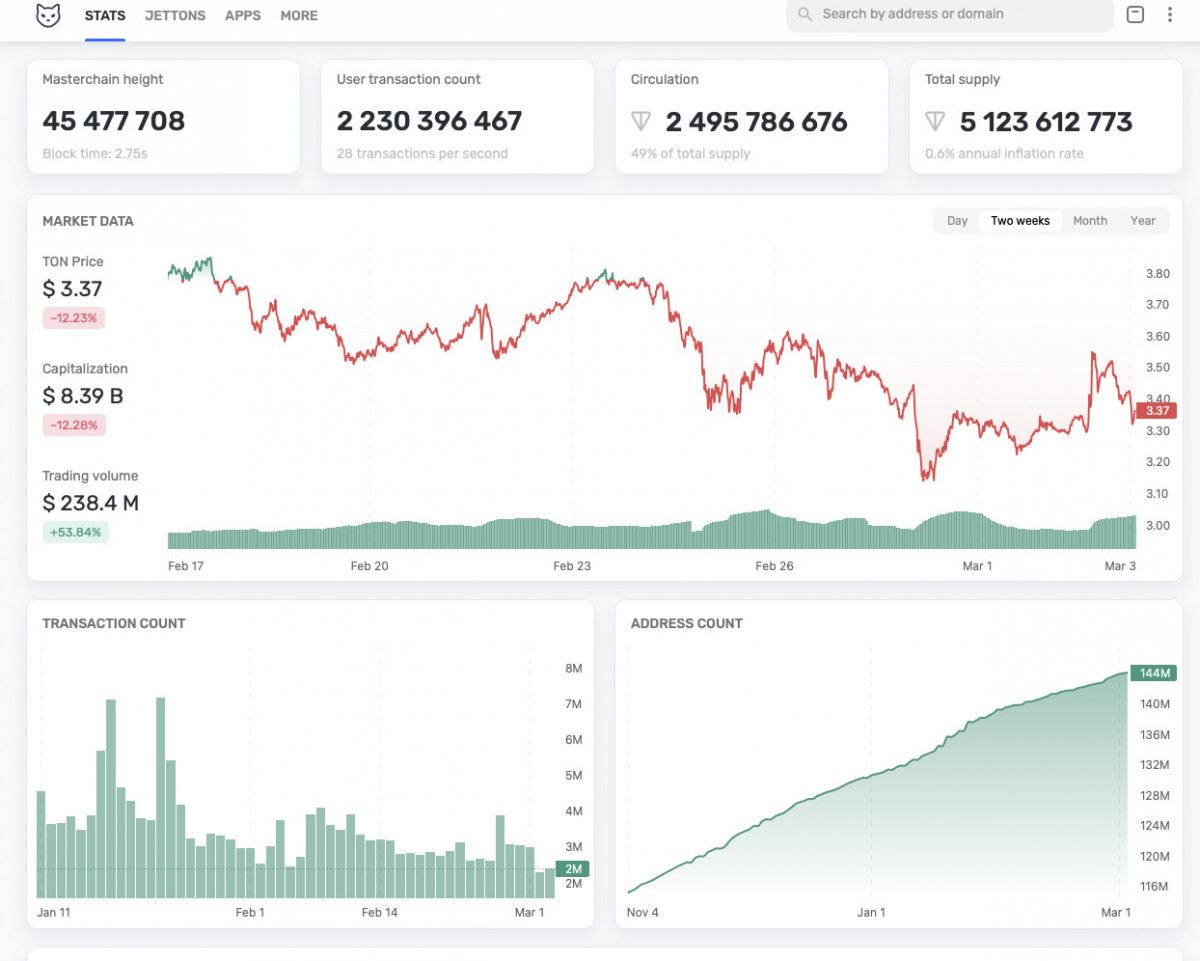

Toncoin (TON)

TON has been doing its own thing, mostly under the radar. Sure, it dipped with the rest of the market, but it held up better than most, bouncing off the $3.10 zone and pushing past $3.50 before smacking into resistance at the 50-SMA (see chart). Classic. The RSI sat at 47.42 – basically in limbo, neither overbought nor oversold, which makes sense given the lack of extreme moves.

TON/USD 4H Chart. Source: TradingView

For one, let’s talk ‘real’ adoption. Over the last 10 months, 1.5 billion USDT has been issued on TON, which is actually a liquidity game-changer.

Source: Artemis

More USDT on a blockchain means better trading conditions, deeper order books, and a sturdier foundation for DeFi. Add to that MyTonWallet launching a Telegram mini-app, so that TON wallets are ridiculously easy to use.

Source: Telegram

Then there’s the upcoming March 2 token unlock – 5 million TON is about to hit the market.

Source: Tronscan

Now, depending on who’s holding and what they plan to do, this could either be a minor bump in the road or a short-term headache. But given how resilient TON has been, any dips might just be buy-the-dip opportunities.

Zooming Out

Short term, there’s volatility ahead – no way around that. The BTC rally might slow down, and TON’s unlock could add some turbulence. But, on a broader scale, crypto is back in the mainstream conversation, and whether you love him or hate him, Trump’s next soundbite is likely to shake up the market all over again.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria d’Este

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.